Yes Bank Share Price 2023

“Yes Bank Share Price Soaring: The Investment Opportunity You Can’t Ignore!”

Table of Contents

Yes Bank Share: Understanding the Past, Present, and Future

Introduction

In the world of finance, investing in stocks and shares can offer lucrative opportunities for individuals seeking to grow their wealth. One such option that has garnered significant attention in recent years is investing in the shares of Yes Bank. Once hailed as one of India’s leading private sector banks, Yes Bank faced considerable challenges that shook the confidence of its shareholders and investors. In this article, we will delve into the history of Yes Bank, the reasons behind its downfall, the measures taken to revive it, and its current standing in the market. Moreover, we will analyze the factors influencing Yes Bank’s share price and explore whether it is a viable investment option for the future.

Understanding Yes Bank and its History

Yes Bank, founded in 2004 by Rana Kapoor and Ashok Kapur, quickly rose to prominence as a new-age private sector bank. The bank established a strong presence by offering innovative products, personalized services, and a focus on corporate and retail banking. It garnered a reputation for being technologically advanced and customer-centric, attracting a large customer base and investors alike.

The Recent Challenges Faced by Yes Bank

However, in the last few years, Yes Bank faced a tumultuous period. It encountered various issues, including rising non-performing assets (NPAs), exposure to stressed sectors, and governance concerns. These challenges led to a severe liquidity crisis and eroded investor confidence, resulting in a significant decline in its share price.

Measures Taken to Revive Yes Bank

To prevent the collapse of Yes Bank and safeguard the interests of depositors and shareholders, the Reserve Bank of India (RBI) intervened in 2020. The RBI superseded the board of Yes Bank and formulated a reconstruction plan, leading to a major structural overhaul of the bank’s operations. This involved a strategic investment from a consortium of financial institutions and the infusion of fresh capital, effectively rescuing the bank from a complete meltdown.

Impact of Yes Bank’s Revival on Shareholders

The reconstruction and revival plan positively impacted Yes Bank’s shareholders, as it prevented a complete loss of their investments. The bank’s share price witnessed a gradual recovery, although it still faced fluctuations due to market sentiments and economic conditions.

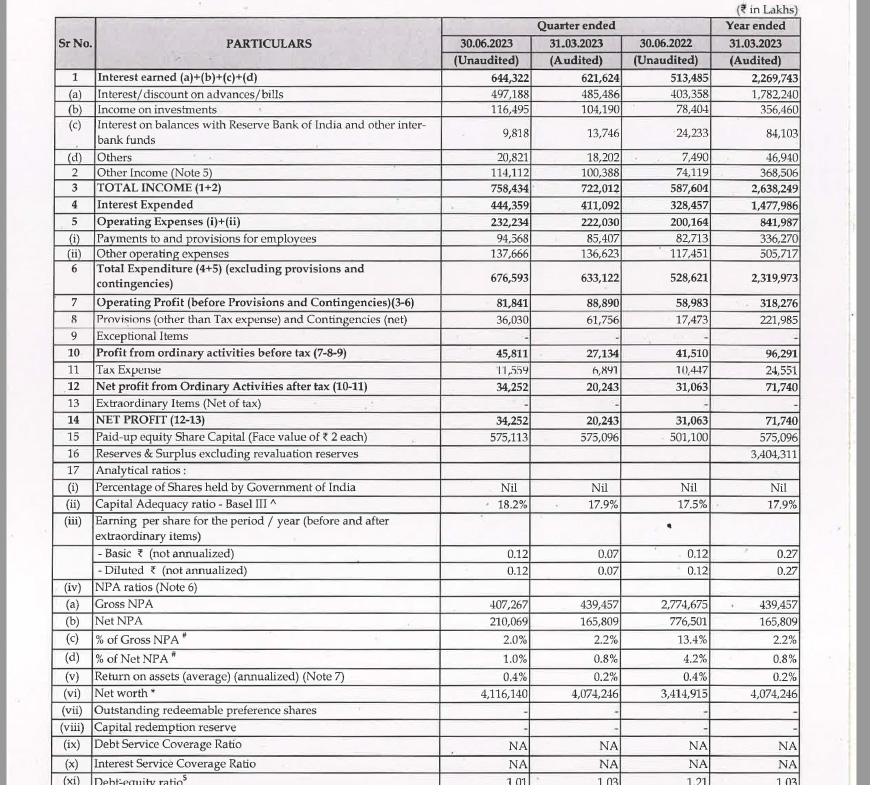

Analyzing the Performance of Yes Bank Shares

Post-revival, Yes Bank’s shares have shown signs of improvement. The bank focused on asset quality, capital adequacy, and digital transformation, which helped regain some investor confidence. However, it is essential to evaluate the bank’s financial performance, growth prospects, and market competition before making any investment decisions. Yes Bank Share Price 2023

Factors Influencing Yes Bank’s Share Price

The share price of Yes Bank is influenced by various factors. Market trends, economic indicators, interest rates, and the overall financial health of the bank play a crucial role in determining the share price. Additionally, any news related to the bank’s performance, strategic partnerships, and regulatory changes can cause sudden fluctuations.

Tips for Investing in Yes Bank Shares

If considering investing in Yes Bank shares, here are some essential tips to keep in mind:

- Research Thoroughly: Conduct in-depth research on the bank’s financials, management team, and future growth prospects.

- Diversify Your Portfolio: Avoid investing a significant portion of your portfolio in a single stock to mitigate risk.

- Long-Term Approach: Consider a long-term investment horizon to benefit from potential growth.

- Stay Updated: Stay informed about the latest developments and news related to Yes Bank to make informed decisions.

Risks Associated with Investing in Yes Bank Shares

While the revival of Yes Bank is a positive sign, there are inherent risks associated with investing in its shares:

- Market Volatility: The share price may experience volatility due to market fluctuations and investor sentiments.

- Regulatory Changes: Any adverse regulatory changes or non-compliance issues can impact the bank’s performance and share price.

- Economic Conditions: Economic downturns or sector-specific challenges can affect the bank’s operations and profitability.

Comparing Yes Bank with Other Banks in the Market

Investors often compare Yes Bank with other banks to gauge its performance and potential. It is crucial to assess the bank’s strengths, weaknesses, and market positioning concerning its peers before making investment decisions.

Regulatory Landscape and Future Outlook for Yes Bank

The regulatory environment plays a significant role in shaping Yes Bank’s future. Continued adherence to compliance, risk management, and governance practices is vital for its sustained growth. As the bank continues to implement its revival strategy and adapt to the changing market dynamics, its future outlook will largely depend on its ability to achieve stability and profitability. Yes Bank Share Price 2023.

Financial Statement

Conclusion

Yes Bank’s journey has been one of ups and downs, and its revival is a testament to the resilience of the Indian banking sector. The strategic measures taken by the RBI and the consortium of financial institutions have given it a new lease on life. While the bank has made considerable progress, potential investors should carefully assess its financial health, market position, and long-term growth prospects before making investment decisions. Yes Bank Share Price 2023.

FAQs

- Is Yes Bank a good investment option right now?

- Yes Bank’s revival plan shows promise, but investors must thoroughly research and consider their risk tolerance before investing.

- What caused the downfall of Yes Bank in the past?

- Yes Bank faced challenges related to rising NPAs, exposure to stressed sectors, and governance concerns.

- How has the government supported Yes Bank’s revival?

- The Reserve Bank of India intervened, formulated a reconstruction plan, and facilitated strategic investments to revive the bank.

- What are the key financial indicators to consider before investing in Yes Bank?

- Investors should focus on metrics like asset quality, capital adequacy, and growth prospects.

- How has Yes Bank’s management changed to avoid future crises?

- The restructuring plan involved changes in management and governance practices to ensure better risk management and compliance. Yes Bank Share Price 2023