Reliance Power Share Price 2023

Reliance Power Share Price: A Comprehensive Analysis

Table of Contents

Introduction

In recent years, investing in the stock market has gained tremendous popularity as people seek avenues to grow their wealth. One such company that often captures investors’ attention is Reliance Power. This article provides a detailed analysis of Reliance Power’s share price, examining its historical performance, factors influencing the share price, and potential future prospects. So, let’s dive in!

1. Understanding Reliance Power Share Price

Reliance Power is a leading Indian energy company that operates across various segments, including power generation, transmission, and distribution. Established in 2007, it is a part of the Reliance Anil Dhirubhai Ambani Group (ADAG) and has been involved in several major power projects across India.

2. The Journey of Reliance Power Share Price

Over the years, Reliance Power’s share price has experienced various fluctuations. In the initial years, there was significant enthusiasm among investors, which drove the share price to peak levels. However, like any other stock, it also faced periods of volatility influenced by market dynamics and company-specific factors.

3. Key Factors Influencing Reliance Power Share Price

Several factors play a crucial role in determining the share price of Reliance Power:

3.1. Financial Performance Reliance Power Share Price

The company’s financial performance, including revenue growth, profitability, and debt levels, has a direct impact on its share price. Positive financial results often attract investors, leading to an increase in the share price.

3.2. Government Policies and Regulations

The energy sector is highly influenced by government policies and regulations. Changes in policies related to tariffs, subsidies, or renewable energy can significantly impact Reliance Power’s share price.

3.3. Industry Trends

Keeping an eye on the overall trends in the power sector is essential. Advancements in renewable energy, shifts in energy demand, and technological innovations can affect the company’s future prospects and share price.

3.4. Market Sentiments

Investor sentiments and market trends play a significant role in short-term share price movements. Positive news or negative rumors can lead to sudden price fluctuations.

4. Recent Developments

Understanding recent developments related to Reliance Power is crucial for investors. These developments may include project updates, joint ventures, partnerships, or any significant change in the company’s management.

5. Key projects

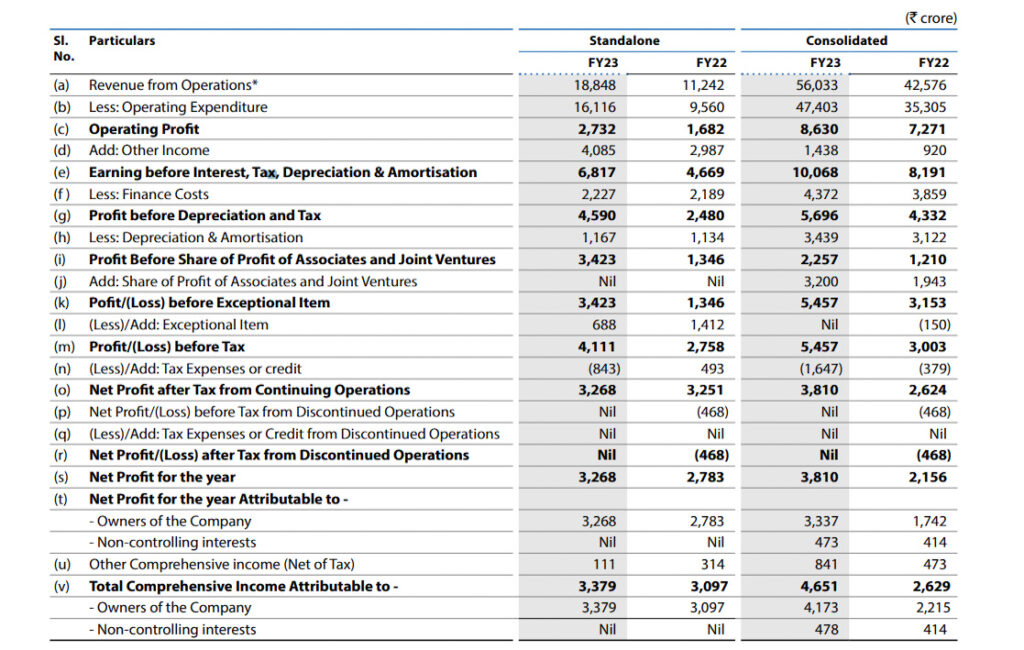

6. Financial statements 2022-23

5. SWOT Analysis of Reliance Power

A SWOT analysis helps in understanding the company’s strengths, weaknesses, opportunities, and threats. This analysis provides insights into the company’s current position and its potential for growth.

5.1. Strengths

- Established presence in the Indian energy sector

- Diversified portfolio of power projects

- Strong financial backing from the Reliance Group

5.2. Weaknesses

- Exposure to regulatory uncertainties

- Dependency on fossil fuel-based projects

5.3. Opportunities

- Expansion into renewable energy sources

- Collaborations with international partners

- Government initiatives promoting clean energy

5.4. Threats

- Intense competition in the energy sector

- Fluctuations in global energy prices

6. Future Outlook

The future outlook for Reliance Power’s share price is influenced by various internal and external factors. Investors should closely monitor the company’s financial performance, expansion plans, and government policies to make informed investment decisions here the video

7. Conclusion

Reliance Power is a significant player in the Indian energy sector, and its share price has witnessed its fair share of ups and downs. As with any investment, potential investors should conduct thorough research, analyze the company’s fundamentals, and consider their risk appetite before making any investment decisions.

FAQs

Q1. Is Reliance Power a good investment?

A1. The decision to invest in Reliance Power depends on your investment goals, risk tolerance, and market research

Q2. How can I track Reliance Power’s share price?

A2. You can track Reliance Power’s share price through financial news portals, stock market websites, or by using trading apps offered by various brokerage firms.

Q3. What are the major risks associated with investing in Reliance Power?

A3. Some of the major risks include regulatory changes, industry competition, market sentiment, and the company’s financial performance.

Q4. Does Reliance Power pay dividends to its shareholders?

A4. Reliance Power’s dividend policy may vary over time. Investors should check the company’s latest financial reports for dividend-related information.

Q5. Are there any upcoming projects that may impact Reliance Power’s share price?

A5. Keeping an eye on the company’s announcements and project updates can provide insights into potential impacts on the share price.